Thursday, September 30, 2010

Thursday, September 30, 2010 Users Are Preferring Apps—And That Includes Finance Apps

Will your mutual fund or exchange-traded fund (ETF) firm eventually produce a mobile application? If your answer to that question is yes, data released in the last few weeks may help move your plans to the front-burner (yep, right alongside everything else).

A global smartphone study by Zokem points to shrinking reliance on Web browsing as mobile users show a striking preference for native applications.

“There is still a lot of usage inside the Web browser,” said Zokem founder Hannu Verkasalo. “However, as mobile consumption patterns get richer, and people learn to require more and more functionalities, the native applications in most cases provide the best user experience.”

Native apps already represent 50% of all mobile data traffic volume, according to Zokem.

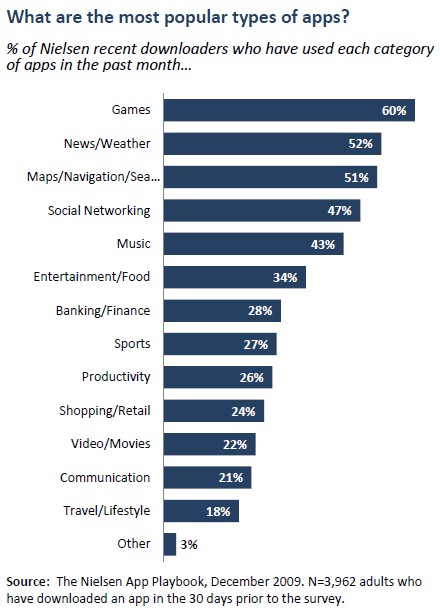

What kinds of apps? Pew Research Center’s Internet & American Life Project released a The Rise of Apps Culture report with data that floored us. Check out this graph that shows:

- A high percentage of apps users get financial information and “do their banking.”

- And it’s a significantly higher percentage than all Internet users.

The report also included December 2009 data from the Nielsen App Playbook that showed that banking/finance apps were more popular than sports and shopping apps! This research predates the release of the iPad and much of the popularity of the Droid.

The report also included December 2009 data from the Nielsen App Playbook that showed that banking/finance apps were more popular than sports and shopping apps! This research predates the release of the iPad and much of the popularity of the Droid.

It’s logical that apps users are more likely than other adults to engage in almost every online activity “due in part to the Web accessibility and increased engagement many apps provide,” according to Pew.

What’s another term for what researchers describe as “increased engagement”? Love! I waxed on about the affection that mobile apps are engendering among their users on a MENG Blend blog post last week (Looking For Love? Bundle the Best of Your Brand in an App).

We “love” our apps. Credit the early app producers for delivering such positive experiences that users are more than open to experimental navigation, continual update cycles and even incomplete information libraries.

We’re willing to overlook inconveniences and hang-ups because using most apps is such a delightful and better experience than having to slug it out on the open Web. This delight, I'm convinced, enhances the user’s brand impression.

Of course, asset management firms, too, would want to find a way to take part--and sooner rather than later.

Reader Comments (2)

Pat,

I think you will see some iPhone / iPad specific apps being developed on a broad basis within the next 3 months by numerous asset managers. In my opinion, the tipping point was the iPad launch and the rapid adoption by executives for personal usage at numerous asset management companies. In the meantime, the first financial services firm to launch a dedicated iPad app was Morgan Stanley.

One other interesting stat, only 3% of current iPad apps are for financial purposes, so there is a large discrepancy between iPad apps and mobile phone apps at the current time.

I recently wrote about both the Morgan Stanley app and the 3% ratio here: http://everydaytenacity.com/asset-management-marketing/ipad-app-and-usage-within-financial-services

Adam, I'm optimistic about the iPads that are on their way from asset managers--not just the number but the type of information that will be available. To borrow the phrase from the Ball State University report and use it in a different way, I think of my time with my iPad as "a play date." Will the asset manager apps consider the "lean back" way iPads are used versus the "lean forward" experience of using a PC? Hope so!

Looking forward to review with you and the others in our small group online focused on asset management communicating.